With great power, comes great responsibility!

Mr X and Mr Y are at different levels in an organization. Mr. X is an employee in an organization which is headed by Mr Y. Mr X’s jurisdiction is very small as compared to Mr Y’s. When it comes to invigilation, Mr. X has to report to his manager and accordingly to the next higher positions which eventually goes up to Mr Y. While Mr Y has to report to the auditors and to the shareholders/owners of the organizations – Mr Y has very less supervision as compared to Mr X.

If Mr X takes a wrong turn and does a fraud of course, it is going to harm the organization and its goodwill but to what extent?

If Mr Y does any fraud, can you imagine the extent of harm which the organization is going to face?

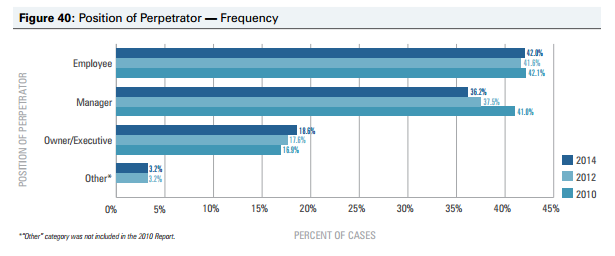

According to a study, the number of frauds done by employees at base level and at managerial positions is very high, and the number of frauds done by higher level (executives/owner) is very less.

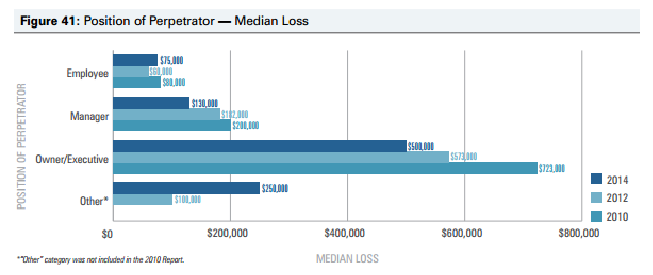

Although, the loss which happens collectively by huge numbered employee group and managerial group versus small numbered owner/executive group says it all:

The financial loss is huge when it comes to executive/owner frauds. Not only the financial loss, the goodwill is also shattered if the head of the organization or a higher management executive does any fraud.

Westar CEO David Wittig was convicted in September 2005 for having taken millions of unaccounted dollars from his company.

Ramlinga Raju, the chairman and founder of software service giant Satyam, admitted that he had fiddled with the firm’s account and that led to major financial crisis in that organization.

In a recent multi-crore Temple Rose fraud case, Ramesh Aghicha (57), who was heading the Pune branch of the company, was nabbed.

These frauds could have been brought to light at an early stage also. The most important thing is – being extra vigilant. Various ways of being vigilant and combating frauds can be:

- Regular Internal and external audits

- Constant Surveillance/Monitoring

- Repeated Management Review

- Strict Documentation Examination

- IT Control

- Complete Account Reconciliation

Every organization needs to be aware of what is going on at all level of its ladder, be it at the junior level or the senior management level. Frauds happen at the top and along with the organization; many have to pay a price for the same. Plus, there is no harm in being extra vigilant, even employees should understand that if they don’t have anything to hide, then let there be more transparency. After all, true prevention is not waiting for frauds to happen; rather it’s preventing frauds from happening in the first place. So, let’s be more vigilant.